When you’re wading into mutual funds, you’re bombarded with words about returns, risk, and diversification. But one crucial element that gets lost in the shuffle is the expense ratio. If you’re asking yourself what this is and how it impacts your investments, you’re in the right spot. Simply put, the expense ratio is the “maintenance fee” on your mutual fund. It can have a significant impact on how much cash you actually bring home in the long run.

In this blog post, we are going to break down exactly what an expense ratio is, how it’s calculated, its parts, and most importantly, why it’s important to you, everyday investors like you. Whether you’re just starting or need a refresher on the basics, let’s keep this simple.

What Exactly is an Expense Ratio in Mutual Funds?

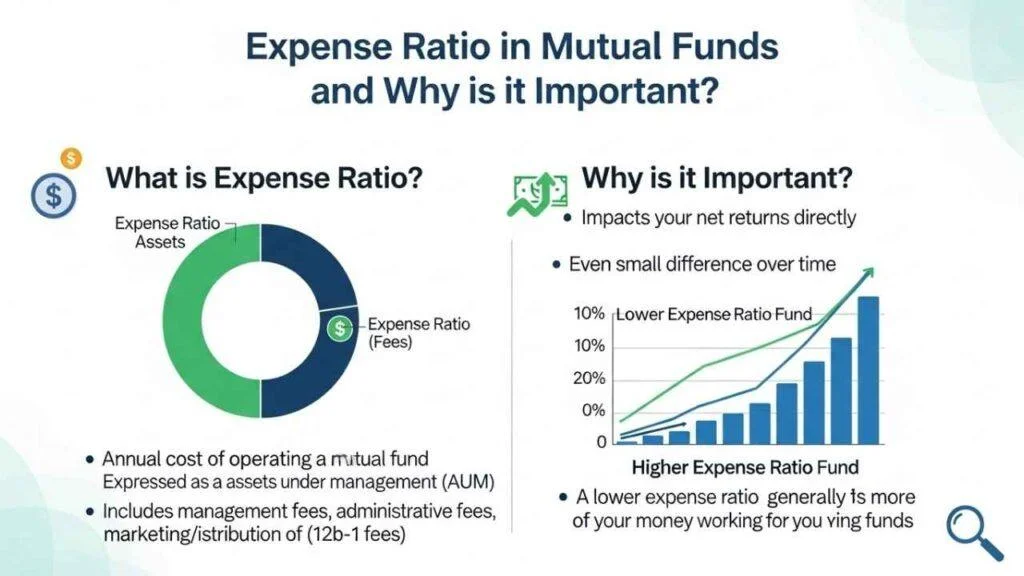

An expense ratio is the yearly fee that’s paid by a mutual fund to its expenses. It’s represented as a percentage of the average assets under management (AUM) of the fund. For instance, if a fund has an expense ratio of 1%, then you’re going to pay 1% of your money each year for the expenses of the fund.

Think of it as the price of putting on the show—paying the fund managers, the administrative personnel, and other expenses. This charge is simply taken out of the assets in the fund automatically, so you never notice it as an added fee on your statement. It’s incorporated right into the fund’s net asset value (NAV), and so lower expense ratios are better for your wallet.

Expense ratios are found in both mutual funds and exchange-traded funds (ETFs), but are particularly relevant in mutual funds where active management increases costs.

Also Read: Mutual Funds vs. Chit Funds: Which is Better for You?

How is the Expense Ratio Calculated?

The expense ratio formula is simple: It’s the fund’s total annual expenses divided by its average Assets Under Management, then multiplied by 100 to express it as a percentage.

Expense Ratio = (Total Fund Expenses / Average Assets Under Management) × 100

For example, if a mutual fund has ₹100 crore worth of assets and spends ₹1 crore every year on expenses, the expense ratio will be 1%. Such expenses are averaged out over the year and deducted from the fund’s NAV every day.

Regulators such as SEBI in India limit expense ratios to safeguard investors—equity funds typically have a cap of 2.25% on the first ₹500 crore of AUM, reducing as the fund size increases.

Key Components of an Expense Ratio

What does this fee consist of? Here is a quick rundown of the major constituents:

- Management Fees: The largest component, compensating the fund manager and research staff for stock or bond picking.

- Administrative Charges: Record-keeping, customer service, and legal expenses.

- Marketing and Distribution (12b-1 Charges): Ad costs as well as broker or platform payment.

- Other Expenses: Custodial charges, audit, and occasionally shareholder reports.

Not all are the same for every fund, but recognizing these makes you realize why some funds (such as passive index funds) have lower ratios than actively managed funds.

Also Read: When Should You Sell a Mutual Fund? A Complete Guide

Why is Expense Ratio Important for Investors?

Here’s where it gets real: Even a small difference in expense ratios can eat into your returns over the long haul. Why? Because these fees compound over time, reducing the money available for growth.

For example, imagine two funds both returning 10% before expenses. If Fund A has a 0.5% expense ratio and Fund B has 1.5%, your net return from Fund A would be 9.5% versus 8.5% from Fund B. Over 20 years, that 1% difference could mean thousands less in your portfolio.

It’s important because:

- Reduces Net Returns: Higher ratios directly reduce what you make. When returns are low, this blow feels even worse.

- Hits Long-Term Worth: Compounding is against you in this case. A lower ratio allows more of your money to compound.

- Sign of Efficiency: Money with lower ratios tends to be more efficient or passive, which is a plus for frugal investors.

- Tax Implications: In tax accounts, higher expenses could result in more distributions, which would increase your tax burden.

It’s easy to forget about it since it’s “invisible,” but being aware can make a huge difference in your overall investment performance.

Also Read: Top 10 Mutual Fund Investment Apps in India in 2025

How to Check the Expense Ratio of a Mutual Fund

Getting this information is simple. Look in:

- The fund’s prospectus or fact sheet (which is available on the fund house website).

- Sites such as Morningstar, Value Research, or AMFI in India.

- Your broker or investment app portal.

Compare ratios of the same kind only—equity to equity, debt to debt—to form an unbiased picture.

Tips for Choosing Funds with Better Expense Ratios

- Be Passive: Index funds and ETFs have the tendency to have lower ratios (0.1% to 0.5%) than active ones (1%+).

- Verify Direct Plans: In India, direct mutual funds avoid distributor fees, reducing the ratio by 0.5-1%.

- Be Aware of Hidden Charges: Expense ratio does not account for transaction charges or exit loads, so include those.

- Avoid Chasing Low Ratios Blindly: A marginally higher ratio may be justified if the fund performs well consistently.

Keep in mind, the aim is value for money—harmonize costs with probable returns.

Also Read: SIP (Systematic Investment Plan) vs Lump Sum Investment – Which is Better for You?

Final Thoughts on Expense Ratio in Mutual Funds

In summary, expense ratio is a quiet killer that can ruin or make your mutual fund investments. Keeping it low makes sure more of your hard-earned cash earns for you, which translates to improved long-term outcomes. As an investor, always consider it when making your choices—it’s one of the only things you can control in the volatile game of markets.

If you are constructing your portfolio, begin with examining the expense ratios of your existing funds. Have questions or experiences to share? Leave a comment below!

Disclaimer: This post is for educational purposes only. Consult a certified financial planner prior to making investment decisions.