When you invest in mutual funds, it makes sense to know the tax principles and be able to save money and make informed investment decisions. If you’re mystified about how your returns on mutual funds are taxed, rest assured you’re not alone. The tax principles for mutual funds in India have evolved through time, and they apply differently to different types of funds.

In this detailed blog post, I’m going to explain everything you need to know about mutual fund taxation in simple language and highlight the major differences between equity and debt fund taxation so that you can plan your investments more wisely.

Before getting into the nitty-gritty, here are the important basics that every investor should know:

Mutual funds are taxed differently depending on whether they mostly invest in stocks (equity funds) or bonds (debt funds). Your holding period makes a big difference – the length of time you keep your investment will directly influence your tax rate. Recent tax changes in 2024 raised some tax rates, so it is important to know about the current rules to make effective tax planning.

Types of Taxes on Mutual Funds

When you invest in mutual funds, you may have to pay two broad categories of taxes:

Tax on Dividends

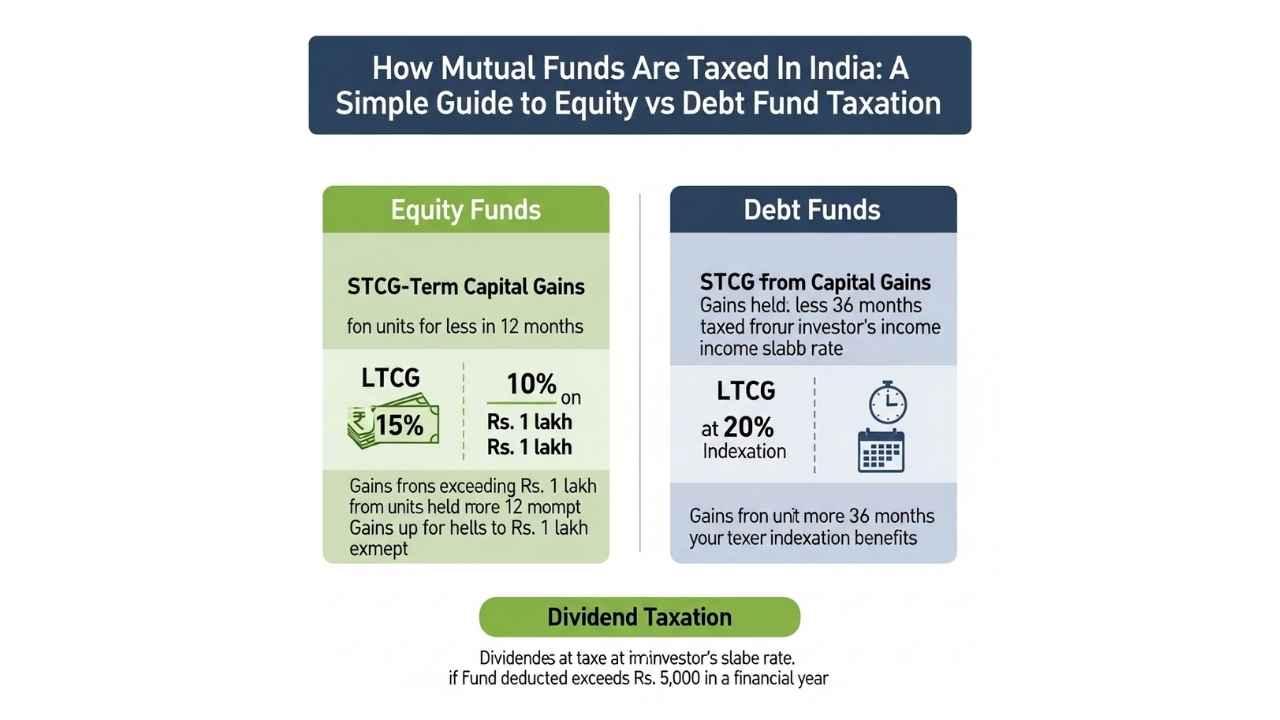

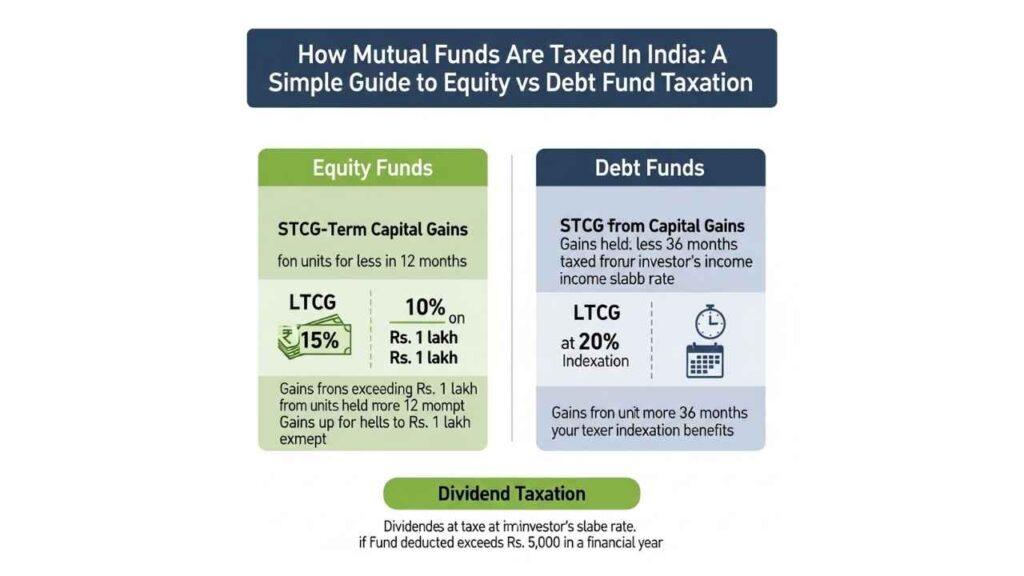

When mutual funds distribute dividends to you, the amount is added to your income and taxed as per your income tax slab. The system of taxation of dividends underwent a change in 2020 with the repeal of Dividend Distribution Tax (DDT).

If you get over ₹5,000 in dividends in a fiscal year, the fund house will withhold 10% TDS on it before disbursing it to you. You can claim the TDS later as credit when you file your income tax return.

Tax on Capital Gains

This is the tax you pay when you sell your mutual fund units at a profit. Capital gains taxation is where the big distinctions between equity and debt funds become visible.

Equity Fund Taxation: Current Rules and Rates

What is an equity fund? A mutual fund is an equity fund if it has invested at least 65% of its assets in Indian company shares.

Short-Term Capital Gains (STCG) on Equity Funds

- When it is applicable: If you are selling your equity fund units within 12 months of purchase

- Applicable tax rate: 20% (which has risen from 15% effective from July 2024)

- Notable point: This tax is applicable irrespective of your income level and is at a flat rate

Long-Term Capital Gains (LTCG) on Equity Funds

- When it is applicable: If you are selling your equity fund units after 12 months of holding them

- Existing tax rate: 12.5% (raised from 10% in July 2024)

- Tax-exempt exemption: The initial ₹1.25 lakh of profits in a financial year is entirely exempt.

- Real-life example: Suppose you earn ₹2 lakh as long-term capital gains, you’ll pay tax at 12.5% only on ₹75,000 (₹2 lakh minus ₹1.25 lakh exemption), which will amount to ₹9,375.

Securities Transaction Tax (STT) on Equity Funds

Every equity fund purchase incurs an extra Securities Transaction Tax (STT) of 0.001% on the transaction price. It is deducted automatically and comes into effect irrespective of whether you gain or lose. The STT is incurred by the seller of units.

Also Read: DNA Markets – Features, Benefits, Set-up & More

Debt Fund Taxation: Complex Rules Based on Investment Timing

What is a debt fund? A mutual fund qualifies as a debt fund if it invests over 65% of its corpus in bonds, government securities, and other debt securities.

Taxation of debt funds has made dramatic changes, and the rules to apply are strongly based on when you invested:

For Investments Made After April 1, 2023

It’s simple but not so beneficial:

- No holding period benefit: All gains are taxed at your income tax slab rate, regardless of how long you hold the investment

- No indexation benefit: You cannot adjust for inflation when calculating your gains

- Tax rates: If you’re in the 30% tax bracket, you’ll pay 30% tax on all debt fund gains

For Investments Made Before April 1, 2023

The rules are more complex and depend on when you sell:

If sold before July 23, 2024:

- Short-term (less than 36 months): Taxed at your income tax slab rate

- Long-term (more than 36 months): 20% tax with indexation benefit

If sold on or after July 23, 2024:

- Short-term (less than 24 months): Taxed at your income tax slab rate

- Long-term (more than 24 months): 12.5% tax without indexation benefit

Also Read: Trade Nation – Offers Zero Commission Trading- Features, Benefits, Set-up & More

Practical Examples to Clarify the Rules

Example 1: Equity Fund Investment

You invested ₹1 lakh in an equity fund in January 2024 and sold it for ₹1.5 lakh in March 2025 (holding period: 14 months).

- Capital gain: ₹50,000

- Classification: Long-term capital gain (held for more than 12 months)

- Tax liability: Since the gain is less than ₹1.25 lakh exemption limit, no tax is payable

Example 2: Debt Fund Investment (Recent Investment)

You invested ₹1 lakh in a debt fund in June 2023 and sold it for ₹1.3 lakh in December 2024.

- Capital gain: ₹30,000

- Tax treatment: Since this investment was made after April 2023, the entire ₹30,000 will be added to your income and taxed at your slab rate

- If you’re in 30% tax bracket: Tax liability = ₹9,000

Example 3: Debt Fund Investment (Pre-2023 Investment)

You invested ₹2 lakh in a debt fund in March 2022 and sold it for ₹3 lakh in September 2024.

- Capital gain: ₹1 lakh

- Holding period: More than 24 months (qualifies as long-term)

- Tax liability: 12.5% on ₹1 lakh = ₹12,500

Also Read: Trade Nation – Offers Zero Commission Trading- Features, Benefits, Set-up & More

Comprehensive Comparison: Equity vs Debt Funds

| Factor | Equity Funds | Debt Funds |

|---|---|---|

| Short-term holding period | Less than 12 months | Varies by investment date |

| Short-term tax rate | 20% flat rate | Your income tax slab rate |

| Long-term holding period | More than 12 months | Varies by investment date |

| Long-term tax rate | 12.5% (above ₹1.25 lakh exemption) | Slab rate (new) or 12.5% (old investments) |

| Annual tax exemption | ₹1.25 lakh for LTCG | None |

| Indexation benefit | Not available | Not available for new investments |

| Additional taxes | STT of 0.001% | No STT applicable |

| Dividend taxation | 10% TDS if >₹5,000, then slab rate | 10% TDS if >₹5,000, then slab rate |

Also Read: Fusion Markets – Features, Benefits, Set-up & More

Strategic Tax Planning Tips

Optimize Your Holding Period

For equity funds, holding investments for more than 12 months provides significant tax advantages through lower rates and the annual exemption. For debt funds, especially new investments, the holding period has minimal impact on taxation.

Consider Your Tax Bracket Timing

If you anticipate being in a lower tax bracket in the future, consider timing your debt fund redemptions accordingly. The enhanced Section 87A rebate in Budget 2025, which raised the exemption limit to ₹4 lakh, means individuals earning up to ₹12 lakh might pay zero tax on debt fund gains.

Maximize Annual Exemptions

For equity funds, strategically spread your redemptions across financial years to fully utilize the ₹1.25 lakh annual LTCG exemption. This can result in significant tax savings for large portfolios.

Leverage ELSS for Tax Benefits

Equity Linked Savings Schemes (ELSS) offer dual benefits: tax deduction up to ₹1.5 lakh under Section 80C and favorable long-term capital gains treatment after the mandatory 3-year lock-in period.

Hybrid Funds: Understanding the Rules

Hybrid funds, which invest in both stocks and bonds, follow specific taxation rules based on their equity allocation:

- If equity allocation ≥ 65%: Taxed exactly like equity funds

- If equity allocation < 65%: Taxed like debt funds according to the investment date rules

Recent Regulatory Changes (2024-2025)

The Union Budget 2024 introduced several significant changes that investors must understand:

- Increased tax rates: STCG rate for equity funds increased from 15% to 20%, and LTCG rate increased from 10% to 12.5%

- Enhanced exemption: LTCG exemption limit increased from ₹1 lakh to ₹1.25 lakh

- Removed benefits: Indexation benefit eliminated for most assets, including debt funds purchased before April 2023

Also Read: Eightcap – Features, Benefits, Set-up & More

Common Investment Mistakes to Avoid

Premature Selling

Most investors dispose of the investment shortly before the end of the long-term holding period, thus not availing of beneficial tax rates and exemptions.

Ignoring Post-Tax Returns

Always compare and calculate post-tax returns in analyzing various investment alternatives since gross returns are often misleading.

Overlooking Dividend Tax Planning

For investors getting large dividends, plan for the 10% TDS deduction and ensure that tax filing is done correctly to claim credits.

Also Read: Zerodha Kite App – Features, Benefits, Set-up & More

Investment Decision Framework

Choose equity funds when:

- You have a long investment horizon (5+ years)

- You can tolerate market volatility

- You want to benefit from the ₹1.25 lakh LTCG exemption

- You’re seeking wealth creation over income generation

Choose debt funds when:

- You prioritize capital preservation and stability

- Your investment horizon is short to medium term

- You’re in a lower tax bracket and can benefit from current taxation rules

- You need predictable returns for specific financial goals

Tax Efficiency Strategies

Systematic Withdrawal Plans (SWP)

Think of using SWP for equity funds to systematically harvest gains without violating the annual LTCG exemption limit.

Asset Location Strategy

Keep tax-inefficient assets such as debt funds in tax-favored accounts when possible, and hold equity funds in ordinary taxable accounts to enjoy beneficial capital gains treatment.

Rebalancing Considerations

When rebalancing portfolios, take account of the tax consequences of every trade and schedule them with care to avoid tax realization.

Also Read: Zerodha Kite App – Features, Benefits, Set-up & More

Understanding the Broader Tax Context

The tax regime for mutual funds mirrors overall economic policy goals. The government has increasingly moved towards taxing capital gains at a higher rate while granting certain exemptions to promote long-term investment in stocks.

Budget 2025’s increase in the Section 87A rebate to ₹4 lakh offers scope for lower-tax-paying investors to leverage their debt fund strategy. This is especially advantageous for younger professionals and retired individuals with moderate incomes.

Future Outlook and Staying Updated

Tax regulations keep changing with every budget cycle. The move towards simplification and increased taxation of capital gains is an indicator that:

- Long-term equity investing remains favored through exemptions and lower rates

- Debt fund attractiveness has diminished for higher-bracket investors

- Tax planning becomes increasingly important for optimal after-tax returns

The Bottom Line: By understanding mutual fund taxation, you’re better able to make informed investment choices that meet your needs and tax circumstances. Although equity funds are typically more tax-efficient for building long-term wealth, debt funds continue to play vital portfolio functions in spite of new tax legislation. The trick is incorporating tax factors into your overall investment strategy without allowing them to dominate good investment principles.

Make sure to seek advice from experienced tax professionals and financial consultants for individualized advice, as specific situations can greatly affect best strategies. Tax regulations frequently change, and therefore it is key to be knowledgeable about current laws to ensure successful long-term investing.

Read More: Angel One App – Features, Benefits, Set-up & More