If you’ve ever researched mutual funds, then you’ve likely encountered the term AUM being bandied about. AUM stands for Assets Under Management, and it’s very important in the investment universe. But what exactly is it, and why should you care? In straightforward terms, AUM indicates how much money a mutual fund is managing. It can provide hints on the fund’s popularity, stability, and even how well it will perform in the future.

In this article, we will describe AUM in simple language, how it is computed, and most importantly, its effect on fund performance. Whether you’re a beginner investor or simply interested, this primer will inform you why AUM is important when selecting mutual funds.

What Exactly is AUM in Mutual Funds?

Assets Under Management, or AUM, refers to the aggregate market value of all investments that a mutual fund company holds in custody on behalf of its shareholders. It’s like the size of the wallet of the fund. It comprises stocks, bonds, cash, and other assets in the fund.

For instance, if a mutual fund has invested in stocks valued at ₹500 crore, bonds valued at ₹300 crore, and some cash, its AUM would be the total of these amounts at prevailing market prices. AUM varies daily since market prices keep changing, and money moves in or out from investors.

It’s not solely a matter of one fund—AUM might be used to describe a single scheme, a whole fund house, or even the mutual fund industry as a whole. Industry-wide AUM, as recorded by the Association of Mutual Funds in India (AMFI) in India, is steadily rising as more and more people invest.

Also Read: Fusion Markets – Features, Benefits, Set-up & More

How is AUM Calculated?

It is easy to calculate AUM. It’s the value of all assets in the fund minus any liabilities, although in mutual funds, liabilities are not significant.

Here is the simple formula:

AUM = Market Value of Investments + Cash Holdings + Receivables – Payables

Fund houses record AUM daily at closing market prices. The elements that cause a change in AUM include:

- Market Performance: When stocks or bonds in the fund appreciate in value, AUM increases.

- Investor Flows: New investment (inflows) enhances AUM, whereas redemptions (outflows) reduce it.

- Dividends and Interest: Reinvested income may also increase AUM.

You can see a fund’s AUM on its fact sheet, fund house website, or Moneycontrol or Value Research websites.

Also Read: Zerodha Kite App – Features, Benefits, Set-up & More

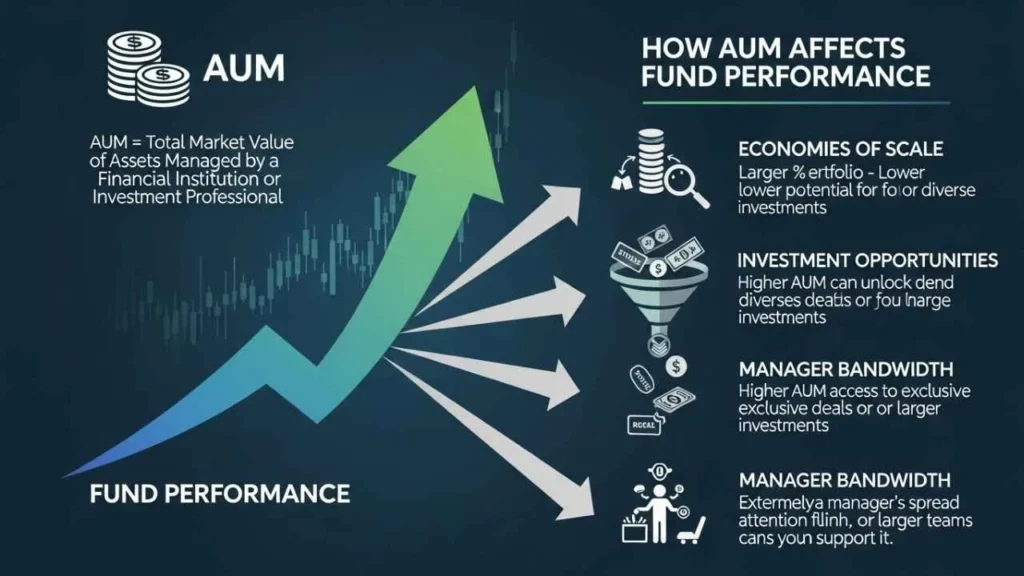

How Does AUM Affect Fund Performance?

AUM is not a number—it can have a direct impact on the performance of a mutual fund. Here’s the positive and the negative:

The Advantages of Large AUM

- Economies of Scale: Larger funds tend to cost less because fixed expenses (such as management fees) are divided among more assets. That leaves more money invested, which can mean higher net returns for you.

- Credibility and Stability: High AUM indicates that numerous investors have confidence in the fund. It could draw better quality and resources, assisting the fund in managing adverse markets.

- Liquidity: Large funds find it easy to purchase and sell assets without large price movements, excellent for efficient operations.

The Drawbacks of Larger AUM

- More Difficult to Navigate: In sectors such as small-cap or mid-cap schemes, a huge AUM can make it challenging for managers to identify quality investment opportunities without influencing the market prices. This can result in underperformance relative to smaller, more agile schemes.

- Style Drift: Funds may change from their initial strategy, such as purchases of larger stocks, to manage enormous inflows, which can water down returns.

- Performance Lag: Research indicates that as AUM increases to a certain level, returns may decline since it’s more challenging to outperform the market.

Conversely, extremely low AUM could imply increased risks, such as shut down in case of poor uptake by investors or increased fees to absorb expenses.

In general, there is no “perfect” AUM—it just varies with the type of fund. For big-cap funds, larger AUM is generally better; for specialty funds, moderate-sized AUM could be perfect.

Why is AUM Important for Investors?

AUM provides you with an idea about a fund’s well-being and also aids in decision-making:

- Measure Popularity: Large AUM generally indicates that the fund is well-performing with more investors following it.

- Compare Funds: When looking at similar funds, check AUM alongside returns and risk to see if size is helping or hindering.

- Industry Trends: Rising overall AUM shows growing investor confidence in mutual funds.

But remember, AUM alone doesn’t guarantee success. A fund with huge AUM might have mediocre performance, while a smaller one could shine.

Tips for Using AUM in Your Investment Choices

- Align with Fund Category: For small stock-focused equity funds, opt for moderate AUM (perhaps less than ₹10,000 crore). For debt or large-cap funds, go large.

- Beware Size Alone: Always investigate past performance, fund manager experience, and expense ratios.

- Watch for Changes: If AUM is increasing too rapidly, look for evidence of strain on performance.

- Diversify Your Stash: Don’t invest everything in one huge fund—invest it out.

Metrics like AMFI’s website or mobile apps may provide avenues for monitoring AUM trends.

Read More: Angel One App – Features, Benefits, Set-up & More

Final Thoughts on AUM and Fund Performance

In summary, AUM is the overall value of assets that a mutual fund has under management, and it is central to performance by influencing costs, liquidity, and flexibility in management. Although high AUM may provide advantages such as fee savings and stability, it may inhibit agility in some funds. As an investor, use AUM as part of the equation, not the entire equation.

If you’re selecting funds, begin with AUM on credible websites and observe how it aligns with your objectives. Has AUM made a difference in your investment? Let us know in the comments!

Disclaimer: This blog post is for informational purposes only. Please seek consultation with a certified financial planner before making investments.