You’re a new investor in mutual funds and possibly heard about SIP, SWP, and now STP. Don’t worry if that sounds puzzling at first—investing does not have to be complex. Today, we’re exploring STP in mutual funds, or Systematic Transfer Plan. It’s an intelligent method to shift your funds between accounts without the aggravation of timing the market. Whether to build your savings or safeguard them from fluctuations, it’s great to know about STP so you can make wiser decisions.

In this article, I’ll discuss what STP is, how it operates, advantages, and when you can utilize it. Let’s dissect it step by step in simple language.

What Exactly is a Systematic Transfer Plan (STP)?

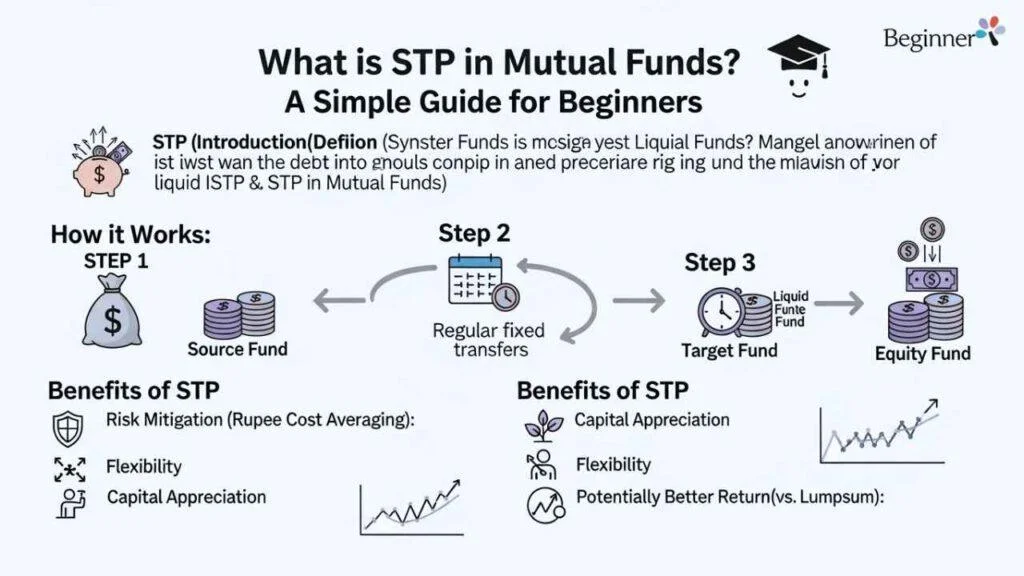

A Systematic Transfer Plan, or STP, is like an automatic transition between two mutual fund schemes. It allows you to transfer a specified amount of money (or units) from one fund to another periodically—weekly, monthly, or quarterly.

Frame it like this: You make a lump investment in a “source” fund (usually a conservative one such as a debt fund), and then transfer tranches to a “target” fund (such as an equity fund for superior returns). This assists in not concentrating all your eggs in one basket at a single point of time, minimizing risk while seeking superior returns.

STP is available with all mutual fund houses in India, and it’s particularly favored by investors who have a large sum to invest but wish to do so in a phased manner.

Also Read: 5 Best Oil and Gas Stocks in India

How Does STP Work in Mutual Funds?

It is easy to set up an STP. Here’s a brief overview:

- Select Your Funds: Select the source fund (where you begin) and the target fund (where it ends). For instance, begin in a liquid or debt fund and move to an equity fund.

- Determine the Amount and Frequency: You decide on a specific amount, say ₹10,000, to move each month. Or, you may opt to send a specific number of units.

- Duration: The transfers remain ongoing until the source fund is depleted or for a predetermined time period, such as 12 months.

- Automation: It’s a set-and-forget arrangement once established. The fund house processes the transfers automatically on the selected dates.

For tax purposes, every transfer is considered a redemption from the source fund and an investment in the target fund for the first time. So, watch out for capital gains tax, particularly if you’re a higher payer.

A Real-Life Example of STP

Suppose you have ₹5 lakh to invest. Rather than investing it all in a risky equity fund, you invest it in a low-risk debt fund. Then, you create an STP to shift ₹50,000 per month to an equity fund.

- Month 1: Transfer ₹50,000 – Now, ₹4.5 lakh remaining in debt fund.

- Month 2: Another ₹50,000 – And so on.

This way, when the stock market falls in Month 3, you’re purchasing more units at a cheaper price. You’re averaging your costs, just like an SIP but with your current lump sum.

Also Read: 5 Best Aviation Stocks in India

Types of Systematic Transfer Plans

Not all STPs are equal. Here are the primary types to be aware of:

- Fixed STP: The most popular. You transfer a fixed number or units at regular intervals. Easy and certain.

- Capital Appreciation STP: Transfers only the gains (profit) from the source fund. This protects your initial investment while transferring growth to the target fund.

- Flexible STP: You can adjust the amount of transfer depending on market conditions. It is more interactive and is appropriate for experienced traders.

Select according to your objective—fixed is awesome for starters.

Benefits of Using STP in Mutual Funds

Why use STP? Some of the advantages are as follows:

- Reduces Risk of Market Timing: No more trying to time the market. Transfers are frequent, so you purchase low and high, averaging your expense.

- Potential for Better Returns: Beginning with a debt fund gives you a bit of interest, and then moving to equity can increase growth in the long run.

- Tax Efficiency: Long-term capital gains tax with indexation benefits apply to debt funds in India that have been held for more than 3 years, reducing your tax liability.

- Discipline in Investing: It promotes systematic investing, ensuring you remain invested without taking impulsive decisions.

- Flexibility: You may suspend or change the STP at any point in time, often without incurring penalties.

Investors utilize STP to transition out of equity into debt as they approach retirement, thereby securing their gains.

Also Read: 5 Best Solar Energy Stocks in India

Drawbacks and Things to Watch Out For

As with any investment vehicle, STP isn’t ideal:

- Transaction Costs: Every transfer may have exit loads or tiny fees, although most funds waive them for STPs.

- Tax Implications: Short-term transfers may invoke higher tax burdens. Always consult a tax consultant.

- Market Risks: In case the target fund performs poorly, your gains could be affected.

- Not for Small Amounts: STP is more suitable for lump sums; for repeated small investments, SIP could be easier.

Just to let you know, past performance is not a guarantee of future performance. Please always look into yourself or speak with a finance expert.

When Should You Consider an STP?

STP is best if:

- You receive a bonus, inheritance, or asset sale that leaves you with a large amount.

- You wish to transition from conservative investments to growth-based investments step by step.

- You’re rebalancing your portfolio, such as moving from equity to debt for stability.

If you’re a conservative investor, the process of debt-to-equity STP can introduce you to stocks smoothly. For aggressive ones, the opposite (equity-to-debt) safeguards profits.

Read More: 5 Best Forex Trading Apps in India

Final Thoughts on STP in Mutual Funds

In short, a Systematic Transfer Plan is an easy-to-use tool for mutual fund investors looking to switch money intelligently between schemes. It encourages discipline, minimizes risks, and can improve returns in the long run. If you are holding a lump sum and do not know where to begin with, then STP may be your companion.

Ready to give it a shot? Ask your mutual fund distributor or log on to websites such as Groww or Zerodha to create one. Investing is all about being regular, so begin small and observe over time.

What do you have to say—have you employed STP previously? Let us know in the comments below!

Disclaimer: This post is for informational purposes only. Please take the advice of a certified financial planner before making an investment.