Hello folks! If you want to increase your money while also cutting taxes, you must have heard of something called ELSS mutual funds. But what are they, and why are they so well-liked by investors in India? In this blog, we will explain everything in plain English. Here, we’ll explain what an ELSS fund is, how it operates, its major advantages, and the tax benefits you can gain. Whether you’re a new investor or simply reviewing your choices, this guide will make you aware of whether or not ELSS is for you.

By the conclusion, you will understand why these funds are a clever approach to integrated wealth accumulation and tax planning. Now, let’s begin!

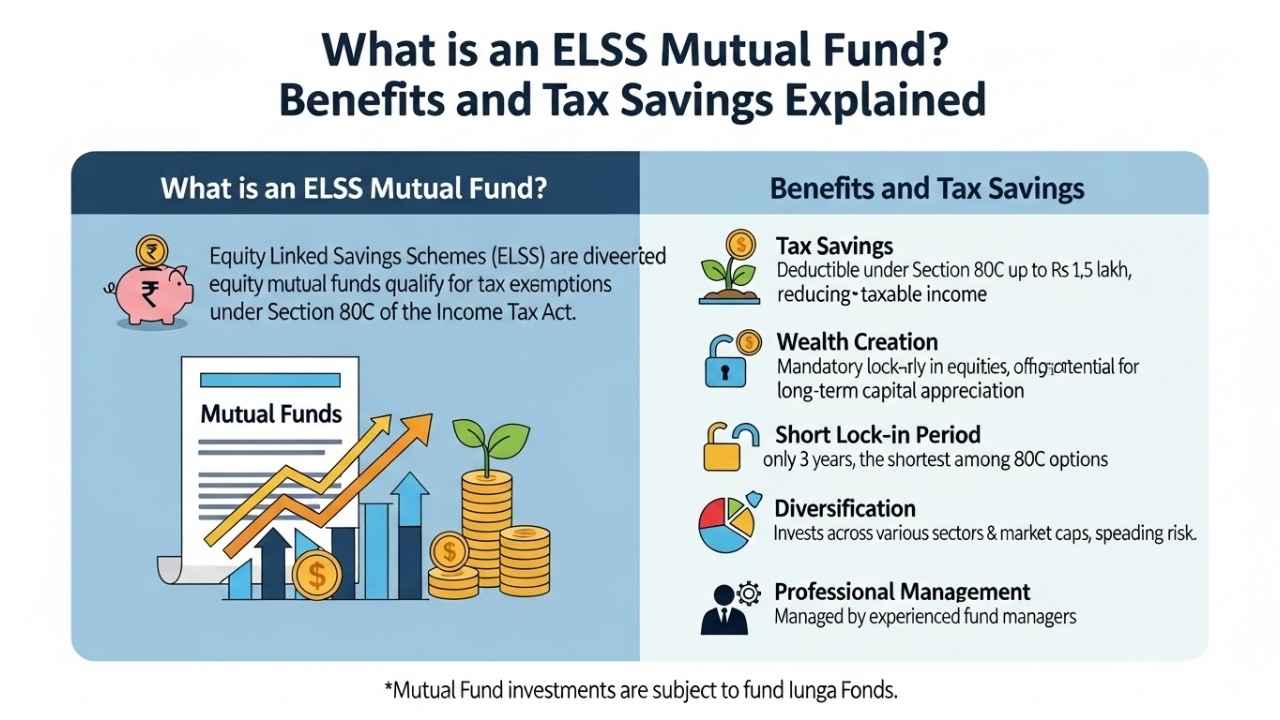

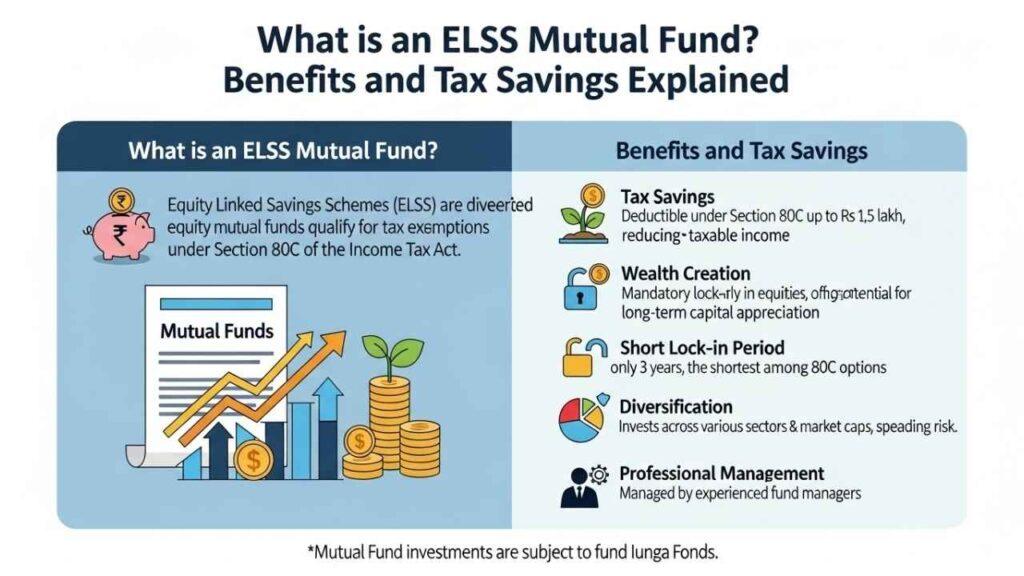

What is an ELSS Mutual Fund?

ELSS is short for Equity Linked Savings Scheme. It’s a mutual fund that invests primarily in stocks (at least 80% of the fund goes into equities). So, what’s special about it? It’s taxed as a tax-saving investment under Section 80C of the Indian Income Tax Act.

In plain words, when you invest in an ELSS fund, you’re purchasing units of a fund run by experts. They select stocks of companies across various sectors to attempt to increase your money over time. For normal mutual funds, you can withdraw your money at any time. But with ELSS, there’s a lock-in period of 3 years—you cannot withdraw your money before then without charges.

These are ideal for individuals who desire exposure to the stock market but also require something to lower their taxable income. They come via platforms such as Groww, ET Money, or even fund houses directly.

How Does an ELSS Mutual Fund Work?

InInvesting in ELSS is easy. You can invest a lump sum (all together) or a Systematic Investment Plan (SIP), wherein you invest smaller amounts on a regular basis, such as monthly.

Here’s the general process:

- Select a Fund: Select an ELSS fund based on its historical performance, fund manager’s performance, and your risk tolerance.

- Invest: Invest before the end of the financial year (March 31) to get tax relief for the respective year.

- Lock-In: Your investment is under lock-in for 3 years from the date of every investment (in case of SIPs, every installment is under lock-in).

- Growth: The fund invests in shares, hence your money can grow as per the market performance.

- Redemption: After 3 years, you can redeem your units and recover your money, hopefully with gains.

Keep in mind, as it’s an equity-based product, the value can increase and decrease with the market. But equities have yielded good returns in the long run.

Key Benefits of ELSS Mutual Funds

ELSS funds are not only about tax savings—there are a host of benefits that make them stand out from other investments. Here’s why everyone loves them:

- Potential for High Returns: Since they invest in equities, ELSS funds have the potential to deliver better returns than fixed deposits or other tax-saving instruments like PPF (Public Provident Fund).

- Shortest Lock-In Period: Section 80C choices, ELSS, has the shortest lock-in period of only 3 years. Contrast this with 5 years for tax-saving FDs or 15 years for PPF.

- Flexibility in Investing: You may invest a minimum of Rs. 500 through SIP, thus it is easy for first-timers.

- Diversification: Your funds are divided among numerous stocks, so there is less chance of investing in a single company.

- Professional Management: Stock choosing is taken care of by the fund managers, so you don’t have to be an expert in the markets.

Overall, it’s a win-win for amassing wealth without making it complicated.

Tax Savings with ELSS Funds

This is where ELSS truly excels! In the erstwhile tax regime in India, you can deduct up to Rs. 1.5 lakh annually on your ELSS investments under Section 80C. Subject to your tax bracket, this can save you up to Rs. 46,800 in tax (if you are in the 30% bracket, along with cess).

A brief aside: Under the new tax regime (which is the default from FY 2023-24 onwards), you cannot claim Section 80C deductions. However, you can still choose to go with the old regime while filing your returns to avail of these benefits.

Also, subsequent to lock-in, any ELSS gains are considered long-term capital gains. If your gains are more than Rs. 1 lakh in a year, they’re taxed at 10% (without indexation). That’s still quite tax-friendly!

For NRIs, you can invest in ELSS, but tax benefits will be based on your residence status and DTAA (Double Taxation Avoidance Agreement) with India.

Pros and Cons of ELSS Mutual Funds

As with any investment, ELSS also has its pluses and minuses. Let’s see them side by side in a plain table:

| Aspect | Pros | Cons |

|---|---|---|

| Returns | Potential for high growth from equities | Market volatility can lead to losses |

| Tax Benefits | Deduction up to Rs. 1.5 lakh under 80C | No deductions in new tax regime |

| Lock-In | Only 3 years—shorter than alternatives | Can’t access money early without penalties |

| Risk | Diversified equity exposure | Higher risk than debt-based options |

| Ease | SIP option for regular investing | Requires some market knowledge |

If you’re okay with a bit of risk for better returns and tax perks, ELSS could be ideal.

Final Thoughts: Is ELSS Right for You?

In short, an ELSS mutual fund is a very effective means of tax saving and generation of wealth, particularly if you fall under the old tax regime. With advantages such as high potential returns, short lock-in, and deduction of up to Rs. 1.5 lakh, it’s no surprise they’re sought after by Indian investors.

All that being said, always evaluate your risk tolerance and financial objectives. If the stock market intimidates you, think about alternatives such as PPF. And most importantly, past results don’t guarantee future returns—do your research or consult a financial advisor.

What about you? Have you invested in ELSS, or are planning to? Write about your experiences in the comments below! If this post was helpful, do not hesitate to share it with friends who could benefit from some tax-saving advice. More simple finance tips on the blog soon!.

Related Post:

- 10 Trading Indicators Every Trader Should Know

- How Many Mutual Funds Should I Own?

- Top 5 Stock Market Apps in India for New Investors

- What Is an IPO? How to Apply for IPOs in India

- Nifty 50 vs Sensex – What’s the Difference?

- What Is the Stock Market? A Beginner’s Guide for Indian Investors

Disclaimer: This post is for informational purposes only and not financial advice. Tax rules can change, so check the latest from the Income Tax Department. Investing involves risks, including loss of principal.