Choosing the right index fund can make a big difference in your investment journey. Index funds are popular because they are low-cost, easy to manage, and offer steady returns over time. But with so many options available, how do you pick the best one for your portfolio? Let’s break it down in simple steps.

What Are the Different Types of Index Funds?

Before you start, it’s important to know the different types of index funds:

1. Sector-Based Index Funds

These funds focus on specific industries like banking, technology, or healthcare. If you believe a particular sector will grow, you can invest in a sector-based index fund to get exposure to that area.

2. Broad Market Index Funds

Broad market index funds track large market indices like the Nifty 50 or Sensex . They give you exposure to a wide range of companies across different sectors, helping you diversify your portfolio.

3. Market Capitalisation Index Funds

These funds allocate your money based on the size of the companies in the index. Larger companies get more weight, while smaller ones get less. This reflects the overall market structure.

4. Factor-Based Index Funds

Also known as smart beta funds, these funds track indexes built around specific factors like value, growth, or quality. They give you exposure to companies that meet certain criteria, such as low price-to-earnings ratios.

5. Equal Weight Index Funds

Equal weight index funds give the same amount of money to each stock in the index, regardless of company size. This means every company, big or small, has an equal impact on the fund’s performance.

6. Debt Index Funds

Debt index funds, or bond index funds, track fixed-income indices. They invest in government, corporate, or municipal bonds, offering diversified exposure to the fixed-income market.

7. Strategy Index Funds

These funds focus on specific investment themes or strategies, such as technology, healthcare, or renewable energy. They let you invest in trends without picking individual stocks.

8. Custom Index Funds

Custom index funds are tailored to meet the unique needs of large investors. They can focus on specific sectors or apply criteria like environmental, social, and governance (ESG) factors.

9. International Index Funds

International index funds give you exposure to markets outside your home country. By tracking indexes from other countries, you can diversify geographically and reduce reliance on a single economy.

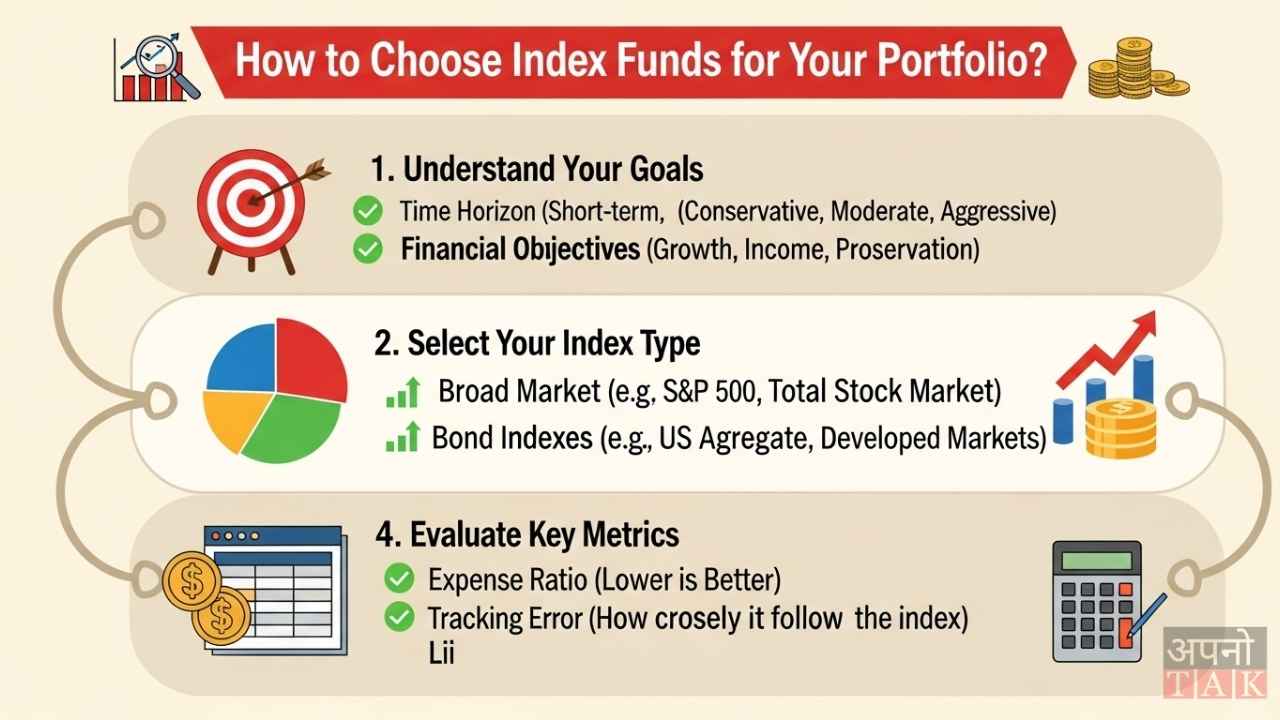

Factors to Consider When Choosing an Index Fund

1. Investment Objective

Think about your goals. Are you saving for retirement, your child’s education, or just building wealth? Index funds are great for long-term goals and for investors who want broad market exposure.

2. Risk Tolerance

Index funds are generally less risky than actively managed funds. If you’re risk-averse, a broad market index fund like Nifty 50 or Sensex might be a good fit.

3. Past Performance

Look at how the fund has performed in the past. While past performance doesn’t guarantee future results, it can help you compare different funds.

4. Fund Manager Reputation

Even though index funds are passively managed, the fund manager’s experience and reputation matter. They handle the fund’s operations and make adjustments when needed.

5. Expense Ratio

The expense ratio is what the fund charges to manage your money. Index funds usually have lower expense ratios than actively managed funds, but it’s still important to compare.

Final Thoughts

Now that you know the different types of index funds and what to look for, you can choose the one that fits your needs. Whether you want broad market exposure, sector-specific growth, or international diversification, there’s an index fund for you. By considering your goals, risk tolerance, and the factors above, you can build a strong, diversified portfolio with index funds. Happy investing!

Related Post: