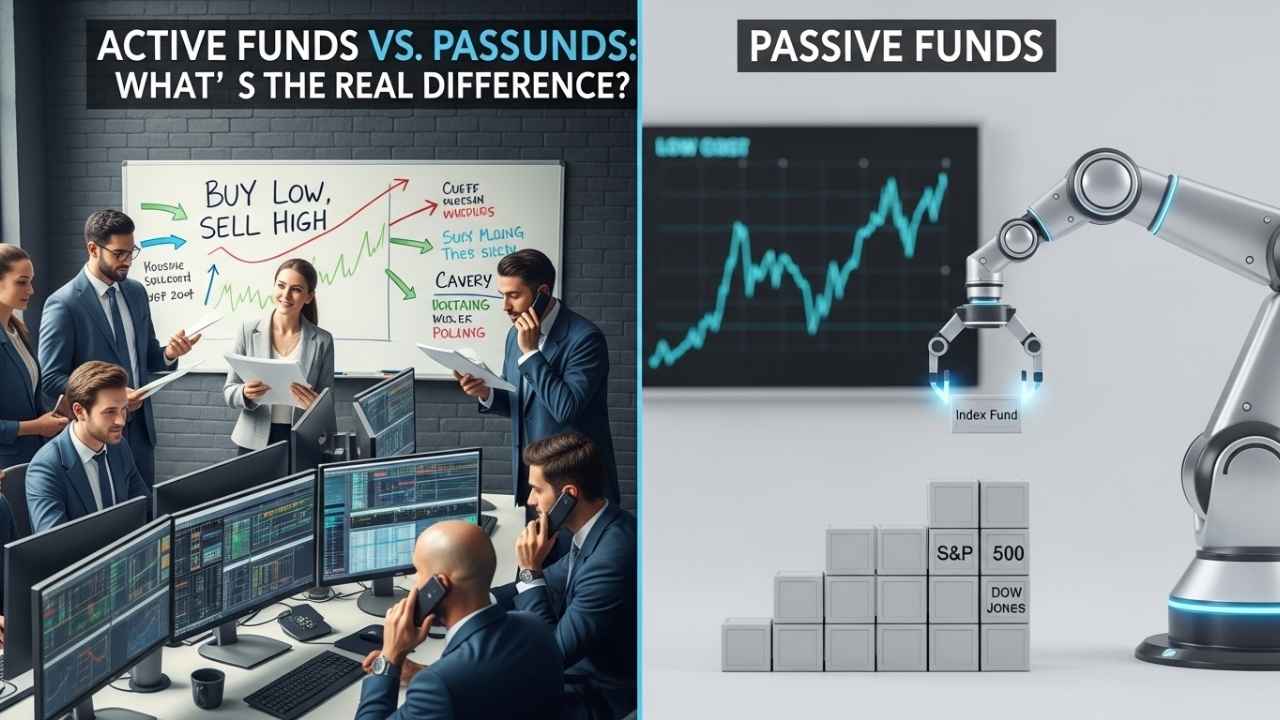

Hello! If you’re just getting your toes wet in investing, chances are you’ve heard these terms “active funds” and “passive funds” being tossed around. But what do they really refer to? And more importantly, which one is best for you? In this blog post, we’ll explain the distinction between active funds and passive funds using simple English. No jargon bombarding you here—just simple explanations to assist you in making wiser decisions with your finances.

Whether you’re a new investor or just wondering how mutual funds and ETFs differ, being aware of this important distinction can save you time, angst, and potentially a great deal of money in fees. Here we go!

What Are Active Funds?

Active funds are similar to hiring a personal trainer for your investments. In active funds, an expert fund manager (or group of experts) actively selects and chooses stocks, bonds, or other investments. What do they aim to do? Beat the market and provide better returns than a typical benchmark, such as the S&P 500 index.

Here’s how it works in simple terms:

- Research and Strategy: The manager spends time analyzing companies, economic trends, and market news. They buy stocks they think will rise and sell those that might fall.

- Flexibility: If the market shifts—say, due to a tech boom or a recession—the manager can quickly adjust the portfolio.

- Examples: Think of popular mutual funds where the manager’s name is often highlighted, like those from big firms such as Fidelity or Vanguard’s active options.

The upside? If the manager is skilled, you could see impressive gains. But remember, this hands-on approach comes with higher costs.

What Are Passive Funds?

On the other hand, passive funds are more of putting your investments on autopilot. These funds will track the performance of a targeted market index, and not attempt to beat it. They won’t rely on a manager’s intuition—instead, they will simply replicate the index.

Key points to know:

- Following an Index: For example, a passive fund could replicate the S&P 500 by owning the same securities in the same weights.

- Low Complexity: There is little buying and selling, keeping it straightforward and inexpensive.

- Examples: Exchange-Traded Funds (ETFs) such as the Vanguard S&P 500 ETF or index mutual funds are traditional passive choices.

The large draw here is affordability and reliability. You’re not shooting for the stars; you’re riding the general market tide.

Key Differences Between Active and Passive Funds

Now that we’ve talked about the fundamentals, let’s have an active funds vs. passive funds head-to-head comparison. I’ll use a simple table to make it easy to compare contrasts:

| Aspect | Active Funds | Passive Funds |

|---|---|---|

| Management Style | Actively managed by experts who pick investments | Passively tracks an index with little intervention |

| Goal | Beat the market for higher returns | Match the market’s performance |

| Costs | Higher fees (1-2% or more) due to research and trading | Lower fees (often under 0.1%) |

| Risk Level | Can be higher if manager’s picks go wrong | Generally lower, tied to market averages |

| Performance | Potential for big wins, but many underperform benchmarks | Consistent but average returns |

| Suitability | For those okay with risk and higher costs | Ideal for long-term, hands-off investors |

As you can tell, the most significant difference is one of involvement and expense. Active investing is playing offense in a game—adventurous and thrilling, but skillful. Passive investing is defensive: consistent and reliable.

A detail to keep in mind: Research indicates that in the long run, the majority of active funds fail to outperform passive funds on a consistent basis after fees are factored in. That is why passive funds have proliferated in popularity over the last few years.

Pros and Cons: Which One Wins?

Each investor is unique, so it’s not that simple. Here’s a brief summary of the benefits and limitations:

Active Funds Pros:

- Chance for superior returns in volatile markets.

- Professional expertise handling complex decisions.

Active Funds Cons:

- Higher expenses eat into your profits.

- Risk of underperformance if the manager makes poor calls.

Passive Funds Pros:

- Lower costs mean more money stays in your pocket.

- Diversification across the market reduces individual stock risks.

Passive Funds Cons:

- No outperformance—you’ll never “beat” the market.

- Vulnerable to market downturns without adjustments.

If you’re just starting out as an investor, beginning with passive funds may be a good bet. They’re perfect for long-term wealth-building without constant vigilance.

Final Thoughts: Choosing Between Active and Passive Funds

Ultimately, whether you choose active funds or passive funds depends on your goals, risk tolerance, and how much you want to get your hands dirty. Active funds bring the excitement of maybe higher returns but at a price, whereas passive funds are simplicity and efficiency.

My tip? Diversify! Most savvy investors blend both—utilizing passive for core stock holdings and active for a specific industry. Do your research or seek advice from a financial advisor before leaping in.

What’s your take? Are you team active or team passive? Leave a comment below—I’d appreciate your opinion! If this was useful, pass it along to a friend just getting started with their investment journey. And keep watching for simple-to-understand finance hacks on the blog.

Related Post:

- 10 Trading Indicators Every Trader Should Know

- How Many Mutual Funds Should I Own?

- Top 5 Stock Market Apps in India for New Investors

- What Is an IPO? How to Apply for IPOs in India

- Nifty 50 vs Sensex – What’s the Difference?

- What Is the Stock Market? A Beginner’s Guide for Indian Investors

Disclaimer: This article is intended only for information purposes and not investment advice. Investing carries risk, and past performance is not indicative of future results.