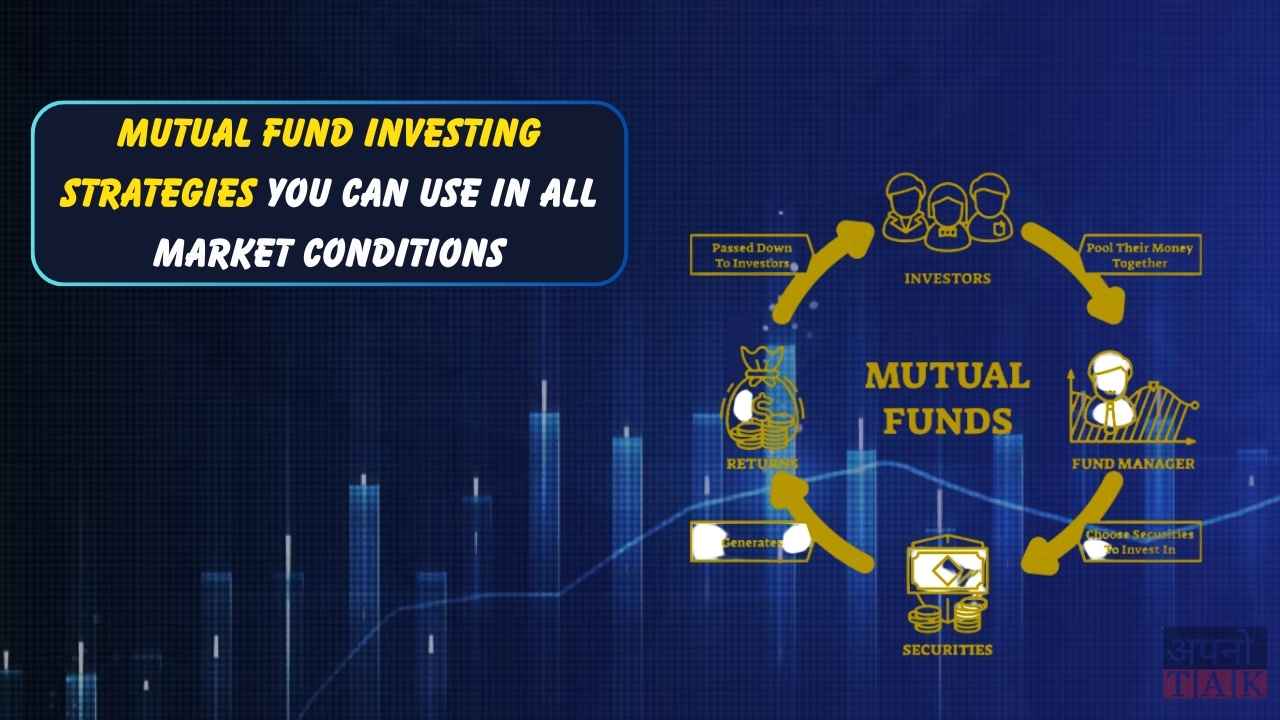

Investing in mutual funds can be tricky, especially when the market is volatile. But with the right strategies, you can maximize your returns and achieve your financial goals, no matter what the market is doing. In this blog, we’ll share some smart mutual fund investment strategies that work in all market conditions.

Top 3 Mutual Fund Investment Strategies

1. Invest Through SIPs and STPs

A Systematic Investment Plan (SIP) is a simple way to invest in mutual funds regularly. You can invest a fixed amount at regular intervals, like monthly or quarterly. The biggest benefit of SIPs is rupee cost averaging. This means you buy more units when the market is down and fewer units when the market is up. Over time, this reduces your average cost of investment.

SIPs are especially useful in volatile markets because they help you avoid the risk of investing a large amount at the wrong time. You get more mutual fund units at a lower price in the long run.

Another option is a Systematic Transfer Plan (STP). With an STP, you transfer a fixed amount from one mutual fund scheme to another at regular intervals. This also gives you the benefit of rupee cost averaging and helps you move your money from a safer fund to a riskier one gradually.

2. Invest in a Balanced Way

A balanced investment strategy means spreading your money across different asset classes, like equity, debt, and hybrid funds. This helps you diversify your portfolio and reduce risk.

You can either invest in multiple mutual funds that cover different asset classes or choose a multi-asset fund that does this for you. A balanced portfolio ensures that if one asset class underperforms, others can make up for the loss.

3. Invest in Sector Funds

Sector funds invest in specific industries, like pharmaceuticals, banking, infrastructure, logistics, or information technology. These funds can be risky because they depend on the performance of a single sector. However, some sectors may do well even when the overall market is down.

If you want to invest in sector funds, make sure it fits your risk appetite. Don’t put all your money in one sector. Instead, use sector funds as a small part of your overall portfolio.

Things to Consider Before Investing in a Mutual Fund Scheme

Before you invest in any mutual fund, keep these points in mind:

- Expense Ratio: This is the fee charged by the fund for managing your money. Lower expense ratios mean more of your returns stay with you.

- Fund Manager’s Experience: A good fund manager can make a big difference in your returns.

- Past Returns: Look at the fund’s performance over the last few years, but remember that past performance doesn’t guarantee future results.

- Investment Objective: Make sure the fund’s goals match your own.

- Asset Allocation: Check how the fund invests its money across different asset classes.

- Risk Appetite: Choose funds that match your comfort level with risk.

- Investment Mode: Decide whether you want to invest through SIPs or lump sum.

Final Thoughts

There are many types of mutual funds, and you can choose the ones that fit your risk appetite and market conditions. If you’re worried about market volatility, use strategies like SIPs, STPs, balanced investing, and sector funds to achieve your financial goals.

By following these strategies, you can build a strong mutual fund portfolio that works in all market conditions. Happy investing!

Related Post: