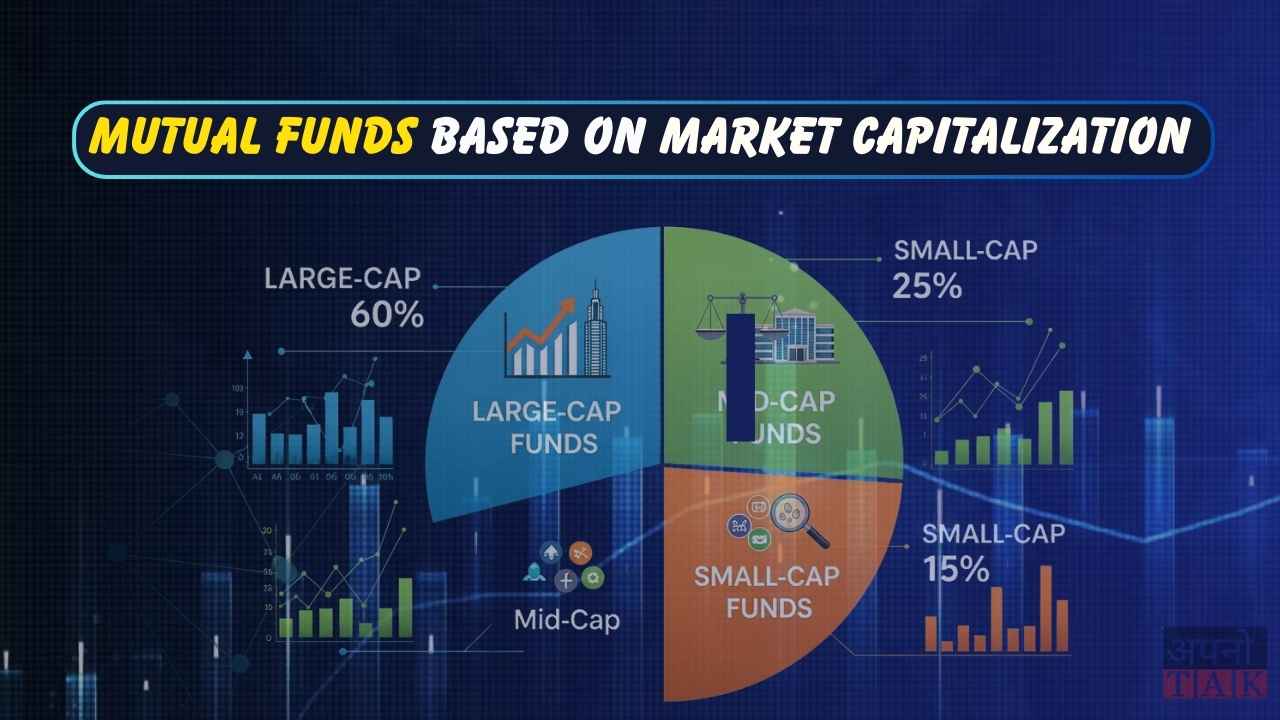

Mutual funds are a popular way to invest in the stock market. One of the main ways mutual funds are classified is by the market capitalization of the companies they invest in. Market capitalization (market cap) is the total value of a company’s outstanding shares. In India, mutual funds are categorized into large-cap, mid-cap, small-cap, multi-cap, and flexi-cap funds based on the market cap of the companies in their portfolio.

Mutual Funds Based on Market Capitalization

Mutual funds are categorised as follows based on the market capitalisation of portfolio companies: large-cap funds, mid-cap funds, small-cap funds, multi-cap funds, and Flexi-cap funds.

Large-Cap Equity Funds

Large-cap funds invest in the top 100 companies listed on stock exchanges like the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). These companies are well-established and have a strong market presence. According to SEBI guidelines, large-cap funds must invest at least 80% of their assets in large-cap companies. Examples include Reliance Industries and Tata Consultancy Services .

Mid-Cap Equity Funds

Mid-cap funds invest in companies ranked 101st to 250th by market capitalization. These companies are generally in the growth phase and offer higher growth potential than large-cap companies, but they are also riskier. SEBI requires mid-cap funds to invest at least 65% of their assets in mid-cap companies.

Small-Cap Equity Funds

Small-cap funds invest in companies ranked 251st and beyond by market capitalization. These companies are usually newer and have higher growth potential, but they are also the riskiest. SEBI mandates that small-cap funds invest at least 65% of their assets in small-cap companies.

Multi-Cap Equity Funds

Multi-cap funds invest in companies of all sizes—large-cap, mid-cap, and small-cap. SEBI requires these funds to invest at least 75% of their assets in equity and equity-related instruments of companies of all sizes. Recently, SEBI has mandated that multi-cap funds allocate at least 25% of their holdings to each category: large-cap, mid-cap, and small-cap.

Flexi-Cap Equity Funds

Flexi-cap funds are similar to multi-cap funds but offer more flexibility. Fund managers can allocate any percentage of the portfolio to large-cap, mid-cap, or small-cap stocks, with no minimum requirements for each category. This allows fund managers to adjust the portfolio based on market conditions.

Key Takeaways

- Large-cap funds invest in the top 100 companies by market cap.

- Mid-cap funds invest in companies ranked 101st to 250th.

- Small-cap funds invest in companies ranked 251st and beyond.

- Multi-cap funds invest in all sizes, with at least 25% in each category.

- Flexi-cap funds invest in any size with no minimum requirements.

Conclusion

Understanding the different types of mutual funds based on market capitalization helps you create a diversified portfolio that balances risk and reward. Each type of fund has its own risk profile and potential returns. By knowing the differences, you can choose the funds that best match your investment goals and risk tolerance.

Related Post:

- Top 5 Stock Market Apps in India for New Investors

- What Is an IPO? How to Apply for IPOs in India

- Nifty 50 vs Sensex – What’s the Difference?

- What Is the Stock Market? A Beginner’s Guide for Indian Investors

- 10 Trading Indicators Every Trader Should Know

- How Many Mutual Funds Should I Own?

Disclaimer: This article is educational only and not financial advice. Trading carries risks—only trade money you can afford to lose. Always research thoroughly and consider consulting a financial advisor before making trading decisions.